Investing is similar to going on a financial trip to increase your wealth. This trip does not, however, come without its deviations. The relationship between risk and return is one important idea that all investors need to understand. To put it simply, it’s about striking the correct balance between the amount of risk you’re willing to accept and the prospective benefits. Let’s see this equation’s significance in the investing world and see why it breaks down.

Understanding Risk

Let’s say you planning a road vacation. You would want to be aware of any possible problems before you drive, such as bad weather, heavy traffic, or poor road conditions. Risk in investments is similar to the ups and downs you experience on your financial path. It’s the unpredictability that accompanies the potential loss of all or most of your invested capital. The risk associated with various investment kinds varies. Larger potential gains are typically associated with larger dangers.

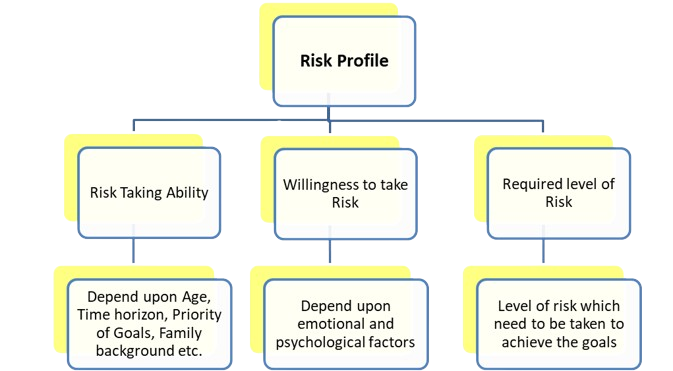

Further, ability to take risk, willingness to take risk, and requirement to take risk are three different things.

Every person has a different risk appetite and accordingly, the investment strategy is to be implemented.

A person might be willing to take higher risk, however, if he is not financially sound, wants his money back in one year, or he is the only earning member in a family of 4 or 5, then there is no point in taking a risk. That person is not able to take risk.

In addition, the requirement to take risk should also be assessed. For instance, a person intends to purchase a car in the next three years for Rs. 10.00 Lakhs. If he already has 80-90% of the corpus for that goal and can achieve a goal with FD returns, then he is not required to take risks with that money.

Risk is a combination of Ability, Willingness, and Requirement. It depends on Age, Time horizon, Priority of Goals, Family background, emotional and psychological factors, etc.

There are five risk categories i.e. Low-Risk Takers, Moderately Low-Risk Takers, Moderate Risk Takers, Moderately High-Risk Takers, and High-Risk Takers.

You should make investment decisions only after understanding your risk profile.

Understanding Return

Now, let’s talk about return. In our road trip analogy, return is like reaching your destination. It’s the reward for taking the journey. In the investment world, return refers to the profit or gain you make on your investment. This can come in the form of interest, profits, dividends, or capital appreciation (an increase in the value of your investment).

The Equation of Risk & Return

Finding the sweet spot in the risk-return equation that corresponds to your comfort level and financial objectives is key. It’s commonly described as a trade-off: assuming greater risk typically entails sacrificing some potential gains. On the other hand, investments with lesser risk usually provide smaller returns.

Also Read – Importance of Risk Profiling in Mutual Fund Investment

Here’s a simple breakdown

Low Risk, Low Return

Investments like government bonds, Bank FD/s, or savings accounts are considered low-risk, but they usually offer lower returns.

Medium Risk, Medium Return

Stocks or diversified mutual funds fall into this category. They have more risk than bonds but potentially offer higher returns.

High Risk, High Return

Pure Equity investments, Small Cap or Mid Cap Mutual Funds, or individual stocks in emerging markets can be high risk, but they also have the potential for substantial returns.

Finding Your Balance

Three primary factors should be considered while making investment decisions: your time horizons, your financial objectives, and your ability to accept risk. You may wish to choose lower-risk investments if your money is being used for a short-term objective, such as purchasing a phone. However, if you are investing for long-term objectives, like retirement or your child’s college education after ten years, you may feel more at ease with assuming greater amounts of risk in the hopes of perhaps reaping better returns.

Conclusion

The relationship between risk and return in the context of investments is similar to a financial compass. Knowing this formula enables you to make well-informed choices to achieve the ideal balance between the returns you hope to get and the amount of risk you are comfortable with. Understand that there is no one-size-fits-all method. It all comes down to figuring out what suits you and matching your investments to your financial objectives.

So, grab a seat, decide where you want to end up financially and have fun!