The Indian financial landscape has been a rollercoaster ride, with dramatic fluctuations in the share market and changing investor sentiments. In recent times, the nation’s equity market has seen unprecedented levels of volatility, leading to a notable decline in equity fund investments by 30% in September 2023. However, amidst this turbulence, there’s been a remarkable surge in mutual fund investments, indicating a paradigm shift in Indian investors’ preferences.

The Volatility in the Indian Share Market

The Indian share market has had its fair share of ups and downs, leaving investors jittery. This heightened volatility has created uncertainty among traditional equity investors who are presently reevaluating their investment strategies.

Equity Fund Investment Takes a Hit

In September 2023, equity fund investments witnessed a significant 30% drop. This trend is reflective of the concerns surrounding the erratic share market performance and its impact on investors’ wealth.

Rise in Investments in Mutual Funds

While equity funds faced a slump, mutual funds have witnessed a surge in popularity. In September alone, investments in mutual funds crossed a staggering 16,000 Crore Rupees. This significant shift is attributed to the safety and diversification mutual funds offer in turbulent times.

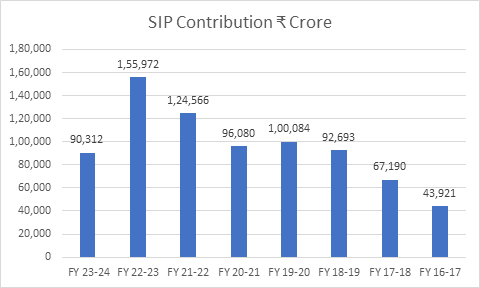

Consistent Upward Trend in Mutual Fund Investments

What’s more striking is the consistent upward trend in mutual fund investments. Over the past few months, investors have demonstrated growing confidence in mutual funds as a reliable investment avenue.

Source – www.amfiindia.com

Rapid Growth in Mutual Fund Accounts

The pace of adoption is staggering. Approximately 37 lakh new mutual fund accounts were opened in a single month. This has contributed to the total number of mutual fund accounts exceeding 7 Crore, indicating that investors are embracing mutual funds in hordes.

The Astronomical AUM

As of now, the Assets Under Management (AUM) in the mutual fund industry stands at an impressive Rs. 47 Lakh Crore Rupees. This number underscores the sheer size and impact of mutual funds on the Indian financial landscape.

Six-fold Increase in AUM in a Decade

The mutual fund industry has come a long way, experiencing a phenomenal six-fold increase in AUM over the last ten years. This growth is certainly a testament to the growing acceptance of mutual funds as a stable and profitable investment avenue. Mutual Funds Triumph!!!

Conclusion

The current scenario in the Indian financial market paints a picture of evolving investor behavior. The high volatility in the share market has forced investors to reconsider their investment strategies, leading to a substantial drop in equity fund investments. In contrast, mutual funds are gaining traction as a safer and more reliable option for investors. The remarkable surge in mutual fund investments, the proliferation of new accounts, and the substantial AUM growth are undoubtedly, indicators that Indian investors are increasingly favoring mutual funds. This shift is likely to have a lasting impact on the Indian investment landscape, making mutual funds an integral part of a diversified investment portfolio. While the volatility in the share market persists, mutual funds offer a haven of stability and growth potential for Indian investors.

Mutual Funds Triumph!!!