Budgeting Tips

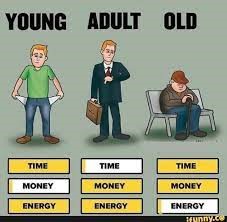

You must have seen below popular post on social media,

Stage No.1

When you are young (or at the beginning of your career), you have a lot of time and energy, but as a fresher, you have less income.

Stage No.2

As you progress in your career and being an adult, you have Energy and Money, but you are short of time.

Stage No.3

As you are near your retirement, you will have a lot of money and time. But, due to the age factor, you won’t have the same level of energy.

Now you’re probably wondering why people are in stage 1. They don’t have enough money. It doesn’t matter how much money you have. As a young professional, you have two important resources: time and energy. You can effectively plan with these two. This preparation will help you as you progress in life, because you won’t have much time in the future, but will have a lot of money to handle.

Here are some tips that are building blocks for your Financial Stability.

Get yourself familiar with numbers

Here, what I mean is that you can’t calculate your total actual expenditures if you don’t know how much you spend or have to spend. To plan for any goal, you will need the actual figures. Saving and investing will come later. The first step is to understand your spending habits. It depends on the dependent family members.

Budgeting: Be real

Budgeting simply includes record keeping of your income and expenses. Divide your spending into categories (for example, necessities and luxuries) to discover areas where you might potentially save money.

Try to follow 50/30/20 rule of spending. (50% towards necessities, 30% towards wants & minimum 20% towards savings). Don’t ignore creating an emergency fund and tracking annual expenses such as payment of insurance premiums, taxes, school fees of children, festival expenses, etc. You find out many Excel formats for recording and keeping your income & expenses.

As previously said, creating a budget without understanding increases the likelihood that it would fail or produce incorrect outcomes.

Learn to Prioritize Investments

Create a habit of saving from the start of your career. Aim to save at least 20% of your monthly income. To make saving easier, create a separate savings account and automate monthly payments. This can assist you in establishing an emergency fund and working towards long-term objectives such as purchasing a home or planning for retirement.

After ensuring that you are able to save 20% of your income, concentrate on investing that money according to risk profile and asset allocation. Saving is not enough to fulfill your financial goals due to inflation.

Be careful of Debt Trap

As you start earning, you get many lucrative offers from finance companies such as free credit cards, 0% loans, buy now & pay later, etc. Don’t get attracted to these offers and avoid availing bad loans such as personal & loans with high-interest rates that are used for depreciating items.

Debt limits your ability to invest and traps you in a vicious cycle that will lead you to lose money in the future.

Spend Mindfully

Money brings with it the urge to enhance your living. Up to a certain extent, it is acceptable and correct. That’s why we earn for. However, be mindful when you are spending on lifestyle or luxury items. Buy it only when it is necessary. Not because, your neighbor has it. It is going to stop you from creating wealth.

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” – Will Rogers

Reevaluate your spending patterns on a regular basis and avoid raising your costs at the same rate as your pay. Instead, put the extra money into savings or investments.

Planning for Financial Goals

As a young professional, you may not have clear goals for life in front of you. However, start with fixed goals such as Retirement Planning or purchasing a new car or house. Deploy your money into that. One more thing you can do is assess your Risk Profile and decide on Asset Allocation for investment.

As you progress in life, always ensure to recheck your Risk Profile and decide on Asset Allocation and make changes in your investment plan.

Having specific financial objectives can keep you motivated and focused. Set both short-term objectives, such as paying off a specific debt or saving for a vacation, and long-term goals, such as retirement planning or purchasing a home. Break these objectives down into manageable milestones and track your progress on a regular basis.

Be Flexible

Financial Planning is not a one-time activity; it must be reviewed and adjusted on a regular basis. Every few months, review your budget to discover opportunities for improvement. Analyze your spending habits, eliminate needless costs, and reallocate investments according to your changing financial objectives.

“Be clear about your goal but be flexible about the process of achieving it.” – Brian Tracy

Invest in Yourself

Investing in yourself means working on your abilities. Educate yourself financially and implant good financial habits. Investing in your financial education will pay you in the long term. Reading book is an easy way to improve your personal financial knowledge.

However, remember that you cannot master every field. Hence, take a professional advice whenever it is necessary. Financial Planners / Advisors are experts in that field and help you in a better way.

Conclusion:

You can create good financial habits and build a strong financial foundation for the future by implementing these budgeting tips. Remember, finance is about making intentional decisions to ensure your investment matches your objectives and values, not about restricting yourself. Begin early, maintain discipline, and enjoy the journey to financial security!