Having a strong financial foundation is like having a solid base for a tree to grow. It gives us the support we need for our dreams and goals. Think of it as the groundwork that helps us handle unexpected challenges and make the most of opportunities. Just like a sturdy house needs a strong foundation to stand tall, a good financial base helps us weather financial storms and build a secure future. It’s like having a reliable map for our money journey, guiding us to where we want to go. So, whether it’s saving for a dream or being ready for a rainy day, a strong financial foundation is the key to a more stable and confident life.

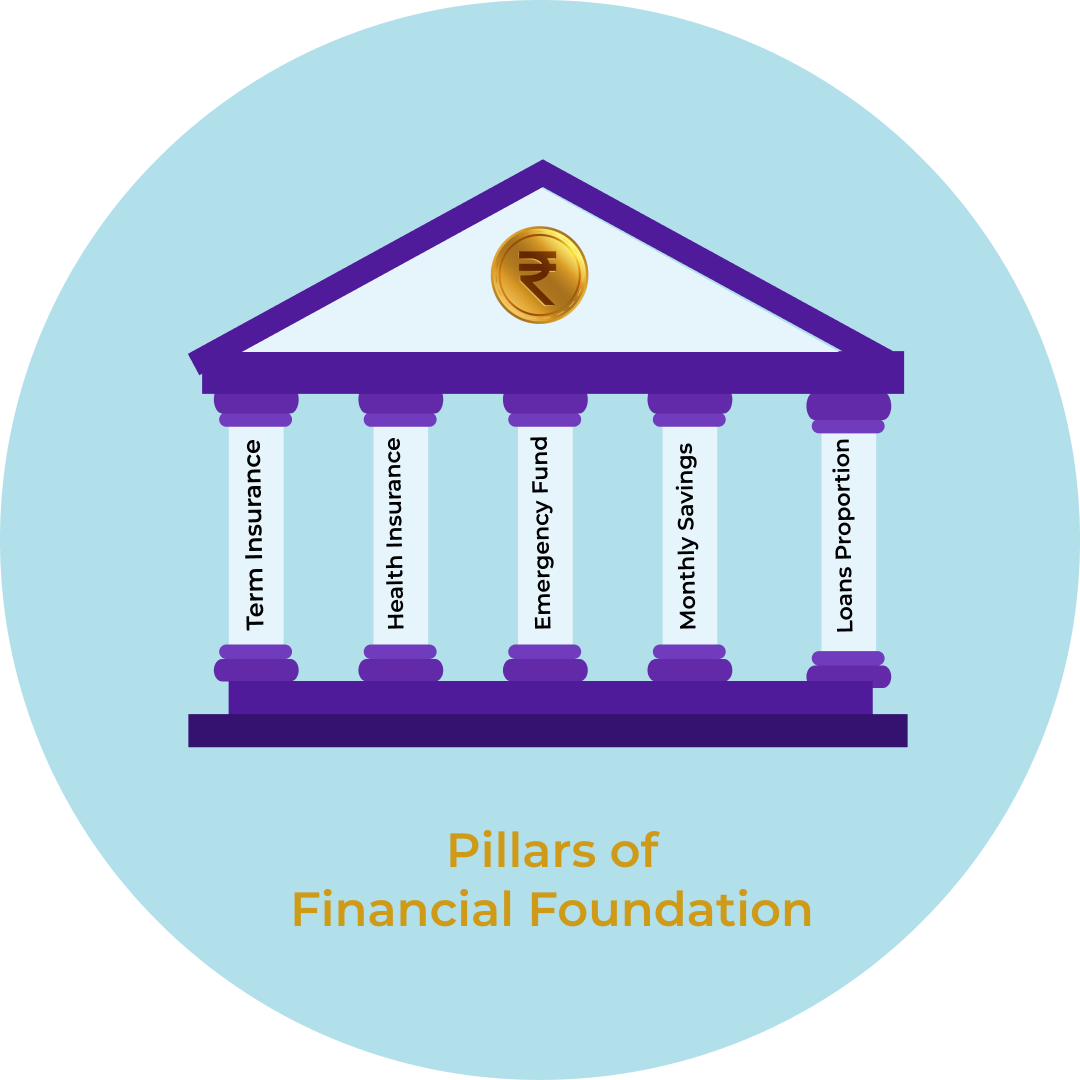

A strong financial foundation is built on 5 important pillars.

- Term Life Insurance

- Health Insurance

- Emergency Fund

- Monthly Savings

- Loans proportion

Let’s understand why these points are considered as pillars of financial life.

Term Life Insurance

Term life insurance plays a crucial role in securing the financial well-being of our loved ones. Unlike other insurance policies, term life insurance provides straightforward protection for a specified period. It ensures that our family is financially safeguarded in case of an unforeseen event. It serves as a safety net, offering peace of mind during life’s uncertainties.

Term life insurance is a more accessible and sensible option for individuals looking for dependable coverage because its premiums are often less expensive. Term life insurance is a vital way for people to leave a legacy of financial stability and to give their dependents a safety net in case anything unforeseen happens. It provides a sense of security in an uncertain environment by prioritizing the long-term wellbeing of our family and loved ones wisely and responsibly.

Term Life Insurance cover should be a minimum 10 times of your Annual Income.

Health Insurance

Health insurance stands as a vital shield in the realm of personal well-being, offering a crucial layer of protection against the uncertainties that accompany medical challenges. It serves as a financial safety net, preventing the burden of exorbitant medical expenses from becoming a barrier to receiving necessary care. With health insurance, individuals can access a variety of healthcare services without the fear of draining their savings or going into debt (Loans). It promotes a proactive approach to health by encouraging regular check-ups and timely treatments.

In essence, health insurance is not just a policy; it is a passport to a healthier and more secure life. It assures that, in times of illness or injury, the focus can remain on recovery rather than financial strain, underscoring its indispensable role in fostering individual and collective well-being.

Health Insurance minimum of Rs. 5.00 Lakhs or 50% of your Annual Family income is a good cover to consider.

Emergency Fund

An emergency fund is the financial superhero we all need in times of unexpected twists and turns. It means saving/keeping aside some money for a rainy day. For example, just in case there is a sudden extra medical expense, loss in business, car repairs, or unexpected job loss, you can survive and handle these setbacks easily. This fund acts as a buffer, preventing these unforeseen events from wreaking havoc on our financial stability. Having an emergency fund is not just a financial strategy; it’s a peace-of-mind strategy, offering the freedom to face uncertainties without the weight of financial worry.

In essence, this fund is the guardian of our financial well-being. It provides a solid foundation for a more secure future.Top of Form

Emergency Fund should be at least equal to 3 times of monthly income. It can go up to 6 times (maximum) of your monthly income.

You can invest this money into Liquid Mutual Funds, Short-Term Debt Mutual Funds, or Bank Fixed Deposits. ‘Safety & Liquidity feature’ is of utmost importance in the Emergency Fund.

Must watch –> Friday FinTalk Video in Marathi

Monthly Saving Habits

It is more important to save money consistently. It will take care of most of your life goals. You can start with a small amount. Always remember “Many A Little Makes Mickle”.

You should save at least 20% – 25% of your Monthly Income.

There is no maximum limit for saving. The larger the savings portion, the faster you will reach the Financial Goals.

Having the right proportion of Loans

To begin with “Loans” cannot be a pillar in a financial life. However, ‘No Loans at all’ or ‘Less loans’ can be a pillar.

When someone takes out too many loans, there’s a high chance he won’t be able to pay them back, which might send him into a debt cycle where he keeps taking out new loans to pay off his old ones. This can seriously impair one’s ability to save and wreck one’s overall financial situation. Therefore, determine if the current monthly payback load is tolerable.

If your monthly loan burden is up to 20% – 25% of your monthly income, then the situation is comforting. If your loan burden is higher, the same weakens your financial position.

Conclusion

This New Year 2024, take the oath to work on these 5 Pillars to build a Strong Financial Foundation. If you have not started, this is a good opportunity to begin. Recheck your amount of Insurance, monthly savings, and emergency fund, if you are already in a journey of improving your finances.

Wish you a very happy new year!