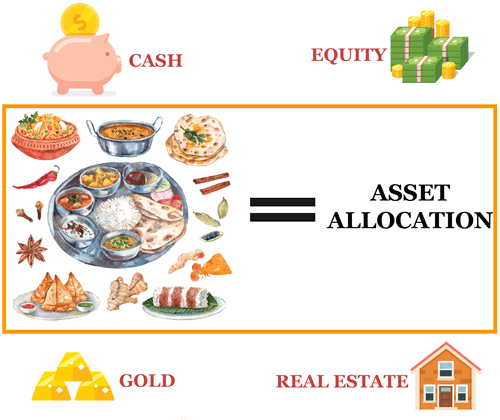

In Indian traditional Thali system we have ingredients like Dal, Chawal, Chapati, Sabji, Chutney, Raita and usually a Sweet. Since these items provide some or the other nutrient to our body since out forefather we have learnt to have these items in our food. While eating our food each of these items are eaten in specific quantity. So mostly Chapati, Chawal Dal and Sabji are consumed more than Raita or Chutney. In the end there is desert as well. Now the quantity of consumption of each item is decided on many factors like geography, health of the person, liking of the person etc. This means that each item is allocated to the body based on so many factors.

Assets Allocation in investments are also similar to Indian Thali system. The best results out of these investments in terms of returns, safety, liquidity etc are ripped when the investment is done in right quantity in right instrument. In this article we shall dwell upon the Asset Allocation in investments.

Types of investments and Asset Allocation:

One of the ways of deciding Asset Allocation is based on the characteristic of that instrument. So the investments are broadly categorised as Cash, Debt, Equity, Commodity and Real Estate. Each of these instrument has it own character in terms of liquidity, returns, risk and taxation benefits

| Type of Investment | Returns Expected | Liquidity | Tax Efficiency | Risk |

| Cash | Low | High | Low | Low |

| Commodity (Gold/ Silver) | Medium | High | Low | Medium |

| Real Estate | Medium | Low | Low | Medium |

| Debt (FD, RD etc) | Low | High | Low | Medium |

| Equity (Mutual Funds or shares) | High in long term | High | High | High during short term |

As you can see in the table above, choosing investment can be based on investor’s preferences. For example, an investor will allocate more amount to an instrument like Debt in case he wish to invest for short with low risk but needs high liquidity accepting the fact that he will have to pay some tax on these investments. On the other hand a person whose investment horizon is long and he is willing to accept some risk can invest in equity so that he will ger higher returns with good liquidity and will have to pay lower taxes.

Age of the person and Asset Allocation:

As a person grows old he is willing to take lesser risk. Hence a person approaching his retirement may wish to invest in Assets having lower risk and asset having higher liquidity. This way he may wish to invest very little into equities and large sum into debt or cash. As against that a young person who has ample of time at his disposal can invest large sum in high risk and high return instruments like equity or equity mutual funds and small amount in other asset classes like debt or cash. Similarly a person in middle of his age would prefer to have Equity, debt and cash in right quantity in his investment portfolio.

Risk Profile of the Investor:

Every person is different than the other. Some people tend to take higher risk, however some other have conservative approach. We as an investment advisor assess Risk Profile of investor before deciding Asset Allocation. Investor willing to go for higher risk will be able to reap higher returns and vice versa. Hence while deciding asset allocation the Risk Profiling of a person is done to understand his nature towards money.

Current liquidity, time period available and cash requirement in the future:

While deciding Asset Allocation we have to consider the current liquidity situation of the investor. We also take into consideration his future goals and time period available for each goal. The longer the goal the higher the risk and more the rewards. The Asset Allocation is not one time affair. It needs to be changed as the time passes. Suppose the investor is approaching his goals, his assets need to be moved to less riskier investments so that he has right amount of money available when he needs.

We at Bonvista Financial Planners, deliberate on Asset Allocation of each of our investor by adopting a methodical approach. The Asset allocation is maintained or changed as per the changing life situations of investor.