Mutual Funds investments are most looked up to for the growth of money. Growth is a basic purpose of any investment. Hence, it is an important aspect to know the rate of growth or the percentage at which our investment is growing.

Now, you would say that we know the returns on our investment. We check our portfolio daily. But, have you ever checked exactly what returns your investment app is showing you? Is it showing you the Absolute Returns, Annualized Returns (CAGR), or XIRR?

Not sure? These 3 returns are totally different from each other. Let’s dig into these one by one.

The key focus of this blog is XIRR, however, we will start from simplest term.

Absolute Returns:

Absolute Returns is the simplest method to understand. It measures the total gains you have made on your investment.

While calculating Absolute returns, you only require to know two amounts. These are,

- Initial Investment Amount

- Current value of investment

For example – You invest Rs 1,00,000/- in 2018 and the current value of your investment is Rs 1,20,000/- in 2022.

What are the Absolute Returns?

Formula:

Absolute Returns = (Current Value – Initial Value) / Initial Value * 100

Absolute Returns = (1,20,000 – 1,00,000) / 1,00,000 * 10Interest 0 = 20%

You have earned Absolute Returns of 20% on your investment.

Limitations of Absolute Returns:

You should not consider Absolute Returns to make an investment decision as it ignores the total holding period of investment.

In above example, 20% returns may sound attractive, however these returns were earned in over 4 years. Hence, per year returns is just 5% (20% /4). Now, your point of view and satisfaction level will change by looking 5% p.a. on your investment.

Annualized Returns (CAGR):

Annualized Returns takes into the account what Absolute returns ignores. And that is, ‘holding period of investment’. Annualized Returns are called ‘Compounded Annual Growth Rate’ as well. It is Return on investment that is measured over one year. This is rate at which your money is compounded annually.

Formula:

CAGR: [(Current Value /Initial Value) ^ (1/no. on years)] – 1

Let’s continue earlier example.

CAGR = ((120000/100000)^(1/4)-1) = 4.66% p.a.

That means your money is compounding by 4.66% annually over four years.

In earlier example we had divided 20% by 4 (years) to arrive at annual returns and answer came to 5%. However, as per CAGR calculation the answer comes to 4.66% p.a. This is because the money is compounding annually by 4.66% and compounding means earning interest on interest. Where when we divide 20% by 5%, we are assuming simple interest.

| Simple Interest on Rs. 100000 (5% p.a.) | Compound Interest (4.66% p.a.) | ||||

|---|---|---|---|---|---|

| Year | Interest | Value | Year | Interest | Value |

| 2018 | 0 | 100000 | 2018 | 0 | 100000 |

| 2019 | 5000 | 105000 | 2019 | 4664 | 104664 |

| 2020 | 5000 | 110000 | 2020 | 4881 | 109544 |

| 2021 | 5000 | 115000 | 2021 | 5109 | 114653 |

| 2022 | 5000 | 120000 | 2022 | 5346 | 120000 |

| Total | 20000 | 120000 | Total | 20000 | 120000 |

So, with CAGR, you would get more clarity regarding your return on investment.

To know more about CAGR,

XIRR:

XIRR is nothing but a ‘Extended Internal Rate of Return’. In above example, you are investing lump sum money (One time) of Rs. 1,00,000/-. What if you invest via monthly SIP (Systematic Investment Plan) or you are just investing on different dates?

How would you calculate your return on investment? Here, XIRR comes into the picture.

XIRR measures your annualized returns when the investment amount is diverse and investment is made on different dates. In this scenario, neither the CAGR nor Absolute returns are useful, XIRR is the only way.

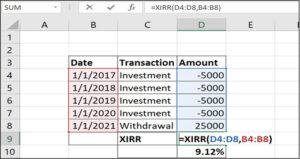

You can easily calculate XIRR in excel.

=XIRR (Value, Dates, Guess)

You need to first select amounts and then transaction dates

XIRR is 9.12% p.a.

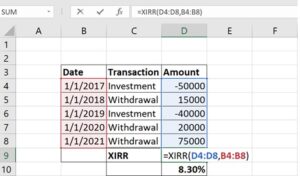

Further, XIRR considers withdrawals during the period (Profit Booking) in the calculation.

If you invest different amount on different dates, or if you withdraw money (profit) is between, you can still calculate annualized return with the help of XIRR function.

XIRR is 8.30% p.a.

So, as you can see XIRR is very flexible function and the most important to know when it comes to measuring the investment returns.

Conclusion:

Return on investment helps you recognize which investments have performed better and where you should be putting your money. This calculation can also help you make a wise investment decision. You can review your investment and make necessary changes in investment.

In case of lump sum investment, CAGR is useful. However, when the investment is made on different dates, XIRR is the function you should use.

XIRR is easily available to compare two different Platters on our platform.

For example, you can compare the performance of “Wealthy Retirement Platter” with “Golden Year Platter” just by checking their XIRR.

Important – Mutual Fund Distributors in Nashik, Thane, Jalgaon and Pune