ULIP & ELSS – Financial year end is around the corner. The most important thing that everyone has on their to-do list is investing to save tax. Tax saving investment is not something that you should do last moment. However, if you have not planned the same, we will help you out in this blog. We are going to focus on the two most popular investment products so that you can take a wise decision.

In this blog, we will see two tax-saving products as under,

- ELSS (Equity-Linked Savings Schemes)

- ULIP (Unit-Linked Insurance Plan)

Similarities between ELSS & ULIP

- ELSS (Equity-Linked Savings Schemes) & ULIP (Unit-Linked Insurance Plan), both offers tax benefits under section 80C of the Income Tax Act in India.

- Being a tax-saving instrument, both have a specific lock-in period.

Now let’s see them one by one.

ELSS:

ELSS is one of the types of a Mutual Fund. It invests in equity shares (stocks) of companies listed on a stock exchange such as BSE & NSE.

Being an equity investment, the returns of ELSS funds are market-linked and volatile, but tend to be higher than traditional investments i.e. fixed deposits and other fixed-income investments.

One of the key factors of ELSS funds is that it has a lock-in period of 3 years which is minimum in all the other tax-saving investments available in the market. Lock-in period of 3 years means the investment cannot be withdrawn before the completion of three years.

ULIP:

Unlike ELSS, ULIP is the insurance product that also offers an investment element. When a person buys an ULIP or any other policy, a certain premium is attached to it. However, in ULIP, the said premium is invested in equity, debt, or a mix of both.

Apart from investment, ULIPs also offer life insurance coverage. ULIPs have a lock-in period of 5 years, which means that the investment cannot be withdrawn before the completion of five years.

Difference Between ULIP & ELSS

Nature

ELSS is a pure investment, whereas ULIP is a combination of Insurance and Investment.

Lock-in

ULIP has a lock-in period of 5 years compared to 3 years for ELSS.

Returns

ELSS invests in equities and equity-related securities, hence, the returns are based on the performance of the underlying equity market. When the market performs well, ELSS funds would generate higher returns, and vice versa.

ULIP, as combines life insurance coverage with investment options, the returns are based on performance of the underlying investment options, which can include equities, bonds, and other securities.

Probability of delivering returns in both investments is different. ULIPs may deliver lower returns than those of ELSS funds, as a portion of the premium is used to cover insurance charges.

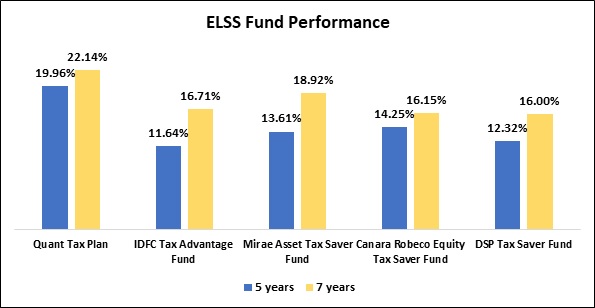

Trailing returns p.a. of few ELSS Mutual Funds as of 22nd February 2023

Source: https://www.valueresearchonline.com/

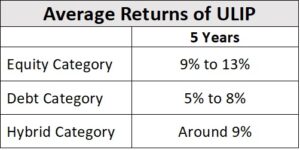

Returns p.a. of ULIPs as of 22nd February 2023

Source: https://www.moneycontrol.com/

Risk

ELSS invests in equities and equity-related securities, hence, the returns are based on the performance of the underlying equity market. When the market performs well, ELSS funds would generate higher returns, and vice versa. Being a pure equity investment, ELSS is a high-risk investment product as compared to ULIP. ELSS is a mutual fund scheme that allocates about 65-80% of the fund to equities as the SEBI rules. As the ULIP can be the mixture of equity, debt, or hybrid fund, the risk factor of the ULIPs decreases.

Taxation

Though both investments offer tax benefits up to Rs 1.5 Lakhs. Being an equity product, ELSS is taxed at 10% (LTCG-Long Term Capital Gain) on and above Rs 1 lakh. It means gains up to Rs 1 lakh is tax-free.

On the other hand, ULIP is taxed as per the new norm of the government under 8AD from February 1, 2021. They are tax-exempt up to Rs. 2.5 Lakh. Thereafter taxed at 10% for long-term gains and at a 15% flat rate for short-term gains.

Expenses

In case of ELSS, there is a fund management charges that is around 1.5% to 2.5% of the Asset Under Management (AUM) per year. There may also be additional charges, such as fund management charges, transaction charges, and exit load.

Expenses in ULIP is generally higher and starts with 2.25%. Premium allocation charges, fund management charges, mortality charges, and administrative charges is also be there in ULIP.

Liquidity

In case of ELSS, the investor can withdraw the money i.e. the sell the MF units on the stock exchange after the lock-in period. The investor can surrender the ULIP policy after the lock-in period.

As ELSS funds have a shortest lock-in period, if offers more liquidity and the procedure of selling MF units is also easy.

Flexibility

Main differentiating point in ELSS and ULIP is flexibility i.e. switching option between the asset classes is available.

ELSS is the only an equity fund and the investors has to invest in equity only. On the other hand, in ULIP investors can choose the type of funds they wish to invest in. Choosing to switch to a different type of fund later on is also allowed in ULIP. The investors can invest in a range of funds from equity to bond funds. Point to note here that this involves switching cost.

Conclusion

Both being tax-saving instruments under Section 80C, it looks similar, but by nature they are different. As far as transparency, returns & ease is concerned, ELSS is the clear winner as ELSS has no hidden charges like ULIP.

Those investors who has higher risk-takin capacity and expects higher returns, can consider ELSS. The another most important benefit in ELSS is that, investment can be started with just Rs 1000/- unlike ULIP.

However, ULIP offers more flexibility as investors can switch among different types of funds during the investment cycle. On the contrary, ULIP has a dual benefit of insurance coverage and market returns. This unique product protects the plan in case of the policy holder’s unfortunate demise. Along with that, it offers corpus creation opportunity.

Important Information – Investment Advisor in Nashik, Investment Advisor in Thane, Investment Advisor in Pune, Investment Advisor in Jalgaon