When it comes to traditional investing, Bank Fixed Deposit is the most popular investment in India. Almost every Indian must have invested their money in Bank FD. From short-term to long-term, Bank FD is the most favorite and easy to understand investment.

However, whenever you are investing for long-term purpose, Fixed Deposits are not the best choice for investment. Though there are many options to invest for short-term, to save for short-term you can consider bank FD because of the assurance of a guaranteed return.

If you are conservative investor and you wish to invest in investment instrument that ensures guaranteed returns, apart from Bank FD, you have an option of Corporate Fixed Deposits.

Let’s understand the concept of corporate FD, its advantages & risk involved.

What is Corporate Fixed Deposit?

We all know that banks offer Fixed Deposits. Similarly, several companies/corporates and NBFCs (Non-Banking Financial Company) are also allowed to collect deposits from general public for a defined period at an agreed interest rate. Deposits offered by corporates are called Corporate Fixed Deposits. The interest rate of corporate FD is assured and investor has an option to choose the tenure of FD. Furthermore, the interest offered by Corporate FD is slightly better than Bank FD.

Features of Corporate Fixed Deposits:

- All individuals, non-resident Indians (NRI), and senior citizens can invest in Corporate FD subject to there age is above 18 years. Minors can invest as well but through guardian.

- Corporate Fixed Deposits and Bank FD, both options offer guaranteed return. Hence, Investors already know the exact maturity amount at the beginning of investment.

- Most corporate Fixed Deposits offer a slightly higher interest rate for senior citizens.

- Investor can decide the period of investment as per his priorities and financial goals. Generally, tenure ranges between one to five years. Please note that Interest rates will change according to the investment period. Higher the tenure, the probability of higher interest rate.

- Corporates offer slightly higher interest rates as compared to bank FD. For example, currently SBI, is providing interest rates of 5.25% to 6.10% for Fixed Deposits of various duration between one to five years. Whereas, the Fixed Deposit by Bajaj Finance is available with interest rate up to 7.75% per annum for similar durations.

- Banks charge the penalty for pre-mature withdrawal. In most cases, it is 1%. However, it is lower in the case of corporate FDs.

What is the risk in Corporate Fixed Deposits?

As the corporate FD offers higher interest rates as compared to Bank Fixed Deposit, one must understand that it comes with a slightly more risk than banks.

Corporate FD also has the risk and that is called default risk. Default risk is when the financial condition of the company deteriorates and it becomes difficult for the company to payback interests or the principal amount.

However, all NBFC/companies who collect deposits from general public, have to adhere to stringent norms and terms & conditions stipulated by the Reserve Bank of India (RBI) & Ministry of Corporate Affairs (MCA). Hence, not all NBFC in India can accept deposits from the public.

RBI is careful when it allows NBFCs to accept deposits from the public to safeguard the interest of public. For that, NBFC has to get registered themselves with RBI, they must have a license to accept deposits. Additionally, the financial assets that the company is managing has to be as per the criteria of RBI.

What is the relation between Interest Rate & Rating of Company?

The Fixed deposits of corporates and companies are usually rated for their credibility by rating agencies. The examples of credit rating agencies are ICRA, CARE, CRISIL, etc. There rating agencies give ratings to companies that can collect deposits from the public.

The criteria of rating include track record of the company, transparency with investors, financials, assets, etc. Depending on how strong they are on each criterion, the companies are given ratings like AAA, AA, BBB, and so on.

AAA is the highest rating (Safest Company) and indicates the company has a strong balance sheet. It is recommended to invest in the NBFC/companies who maintain a minimum BBB rating.

Please note that higher the rating, lower will be the interest rate. The companies having lower rating, they offer the slightly higher interest rate to compensate the investors for taking higher risk.

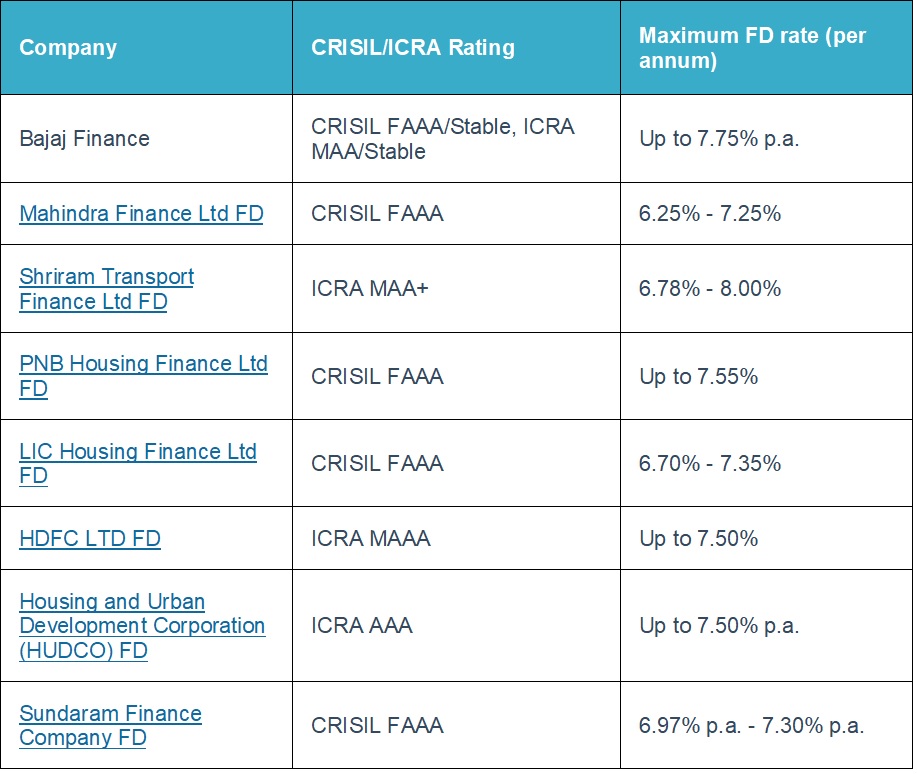

Some of the Corporate FD/s are mentioned below:

Bottom Line:

Though corporate FD is attractive as it offers the higher interest rates, however, please note that if the investment is offering higher interest rate, it involves higher risk.

Corporate FD/s are for you:

- If you are looking to invest for short-term to medium term, with assured returns.

- If you want to higher risk than bank FD and lower risk than Equity Mutual Funds

Don’t forget to check-out the credit rating of the company & your risk profile before investing.

Visit here to check your risk profile – https://app.bonvista.in/riskProfile

Visit our page – Bonds & FDs