As a first step, let’s understand…… What is an investment portfolio? The investment portfolio is nothing but a basket of assets and investments. The portfolio consists of Shares, Bonds, Debentures, Mutual Funds, Bank Fixed Deposits, Other debt investments, PPF, Gold, Property, etc. In short, any asset or investment which you have, can be considered in your investment portfolio.

Do you need different types of Portfolios?

It is important to avoid chaos in your investment. However, you also need to segregate the investments according to the changing needs at a particular point. Maintaining different portfolios is a disciplined way of managing your finances. Achieving your goal will be much easier and faster by adopting this strategy.

What are the types of Portfolios?

Based on Time Frame:

-

Short Term:

- If your time frame is up to 3-4 years, you need to create a short-term portfolio. Liquidity and safety of capital are more important than returns in this type of portfolio. It consists of Debt/Liquid Mutual Funds, Bank FD, Bank RD.

-

Medium Term:

- If your time frame is up to 5-7 years, you need to create a Medium-term portfolio. Moderate returns and capital appreciation are more important in this portfolio but without taking a high risk. It consists of Debt Mutual Funds, Hybrid Mutual Funds, Bank FD, National Saving Certificate, Other Post office investments.

-

Long Term:

- If your time frame is above 7 years, you need to create a Long term portfolio. High returns over inflation and wealth creation are the priority in this portfolio. It mainly contains Shares (Direct Equity) and Equity Mutual Funds, but investors can invest partial amounts in PPF/ NPS for stability, diversification, and tax efficiency.

Based on Risk Profile:

-

Very Conservative

- If you are very conservative in nature and don’t want to take any risk, then guaranteed income schemes such as Post office schemes (Backed by Government) are suitable. In the Mutual Fund category, liquid mutual funds are most suitable. Here, safety of capital is of utmost importance than returns. However, if you have a long-term view, a combination of selective Mutual Funds and long-term debt schemes can be explored.

-

Conservative

- If you are conservative in nature and want safety and stability of capital by taking very little risk, Debt or Conservative Hybrid Mutual Funds, Bonds, Debentures are most suitable. You can also explore NPS or PPF apart from Mutual Funds.

-

Moderate

- If you are a moderate risk taker that means you want safety and stability of capital along with the appreciation of capital. For that, you are ready to take the average risk. Hybrid, Debt, and Large Cap Mutual Funds are most suitable for Moderate investors. Gold in the digital form can also be considered.

-

Aggressive

- Growth in the portfolio is what matters for aggressive investors. It is important to have a long-term view for growth as Power of Compounding works if there is consistency and discipline in the investment. Equity Mutual Funds are the best way to invest for aggressive investors.

-

Very Aggressive

- and financial freedom in the long term. A very Aggressive portfolio focuses on Equity. Potential returns in the category are highest and so is the risk. Very Aggressive investors can go with Stocks, Equity Mutual Funds, International Equity. Additionally, they may explore the PMS (Portfolio Management Scheme) if they have adequate net worth and accumulated corpus.

- One point to be noted here is though the investor is very aggressive, in a few goals, he should adopt a conservative approach such as in creating a portfolio for Emergency purposes.

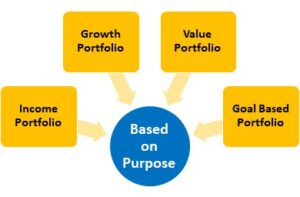

Based on Purpose

-

Income Portfolio:

- This type of portfolio mainly focuses more on steady income flow from investments rather than capital appreciation. Those who desire regular income or retired investors can create an Income Portfolio. You can invest in Debt /Hybrid Mutual funds that pay regular dividends and Bonds/Debentures that pay regular interest. Another option is rental income from property or interest income from investment. The main agenda of the income portfolio is earning steady income without disturbing the principal amount.

-

Growth Portfolio:

- Investors having a long-term view and risk-taking ability can create a Growth Portfolio. For Growth Portfolio, Stocks (Direct Equity), and Equity Mutual Funds, NPS are the best options. Young investors should seek growth in the long term, ideally, it is a long-term portfolio.

-

Value Portfolio:

- Value Portfolio is created by investing money in such kinds of assets that are undervalued (Price is below its potential). When the share market is not performing well, investors can select undervalued companies and invest the money. When the market recovers, the portfolio can earn substantial returns. This value strategy is for long-term investors. The best way to create this portfolio is to invest in Value-Oriented Mutual Funds.

-

Goal-Based Portfolio:

- This is a very effective and practical way to create a portfolio. Firstly you need to list down your goals, the amount required for that goal, future value, time frame, and priority of that goal. Based on all these factors, you need to create a portfolio. If you allocate a particular set of investments to your goals, there are more chances to achieve it and fewer chances of unnecessary withdrawals.

Conclusion:

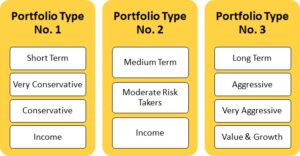

Let’s group the portfolios that can be created with a kind of similar strategy, though not exactly the same.

In short, you need to choose your portfolio according to your needs. There are different types of portfolio to choose from according to your need.

Note – Investment services in Nashik, Investment Services in Thane, Investment Services in Jalgaon, Investment Services in Pune