Return Kitna Milega?

Recently I was in a meeting with one of the clients Mr. Kumar and was discussing about the Investment planning. He interrupted me and asked a question by which I was not surprised at all.

The most common question that clients ask even before understanding the features of the investment is “Return kitna milega?” Basically, Mr. Kumar wanted to know the total amount that he would be getting after a few years.

After listening to his question, I was trying to help my client to have better conceptual clarity about it.

What I shared with my client is the topic of this blog.

So, the corpus which a person can get depends on 3 factors as given below,

First is the amount that you are going to invest, second is time which you are ready to give (for how many years, you are investing) and third is the Return you will be getting.

Most people think that accumulation of corpus mostly depends on the returns on that investment. If they get high returns, the corpus amount is more and vice versa.

But, it is not completely true.

First two factors i.e. investment amount and time can be manageable by you. It means, if you start investing early, you will have more time. Likewise if you are disciplined in investment, you will invest more amount and increase it with period of time.

In short, the first two factors are controllable by you to some extent. But, when it comes to return, it is totally unpredictable and beyond our control. But still we always give highest importance to returns.

Is it right? No.

We should focus more on what we have in our hand.

Still not convinced? It’s ok. Let’s understand this through an example.

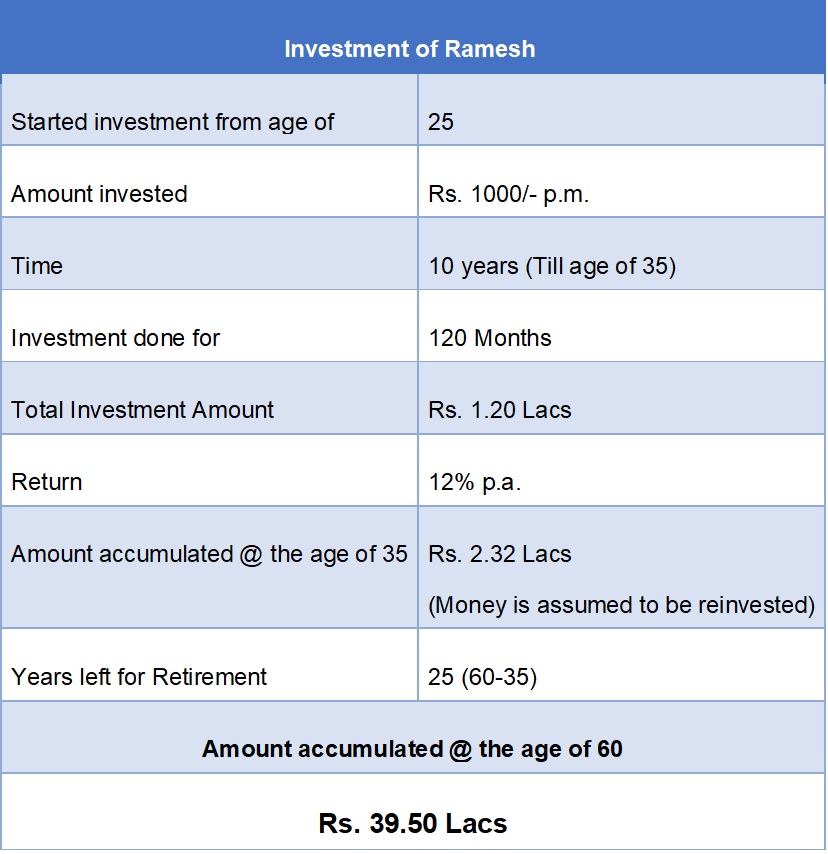

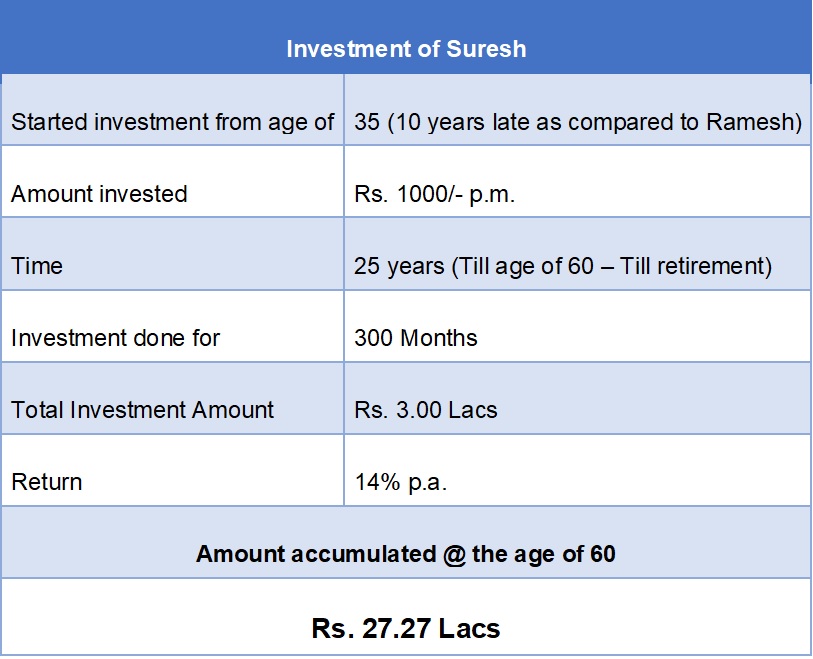

There are two friends, one is Ramesh and one is Suresh. Both are having the goal of Retirement @ the age of 60.

If you observe, in Ramesh’s case, returns are less, total investment amount is also less as compared to Suresh.

But still, the amount accumulated at the time of retirement in Ramesh’s case is more by Rs. 12.23 Lacs.

Why did it happen?

It is just because Ramesh has given more TIME to his money to compound.

Hence, between the 3 factors which I showed you at the start of my blog, TIME is the deciding factor. The more time you give to your investment, the more would be the corpus.

Everyone knows compounding has power. But what gives the power to compounding? It is TIME. Hence, starting early to invest is the key.

Why is it so?

Let’s see another example.

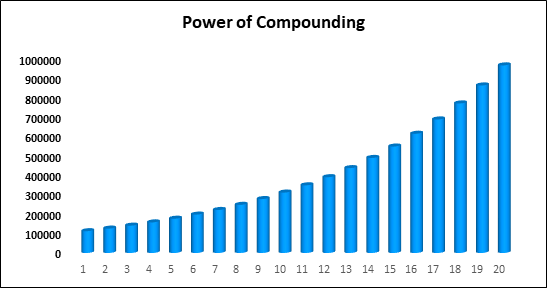

A person invests lump sum Rs. 1,00,000/- for 20 years, assuming interest @ 12% p.a. Following is the graphical presentation,

As you can see, the amount seems constant i.e. the pace of growth is not great for the first 7-8 years. Suddenly after 8th year, you will see a significant rise in the amount. From the 17th year onwards, actual power of compounding is working and money is growing with substantial speed.

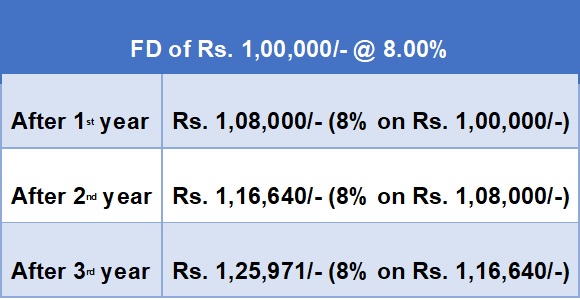

Power of Compounding simply means, earning interest on interest. It takes place when the interest generated on the principal amount in the earlier period is added back to the principal amount in order to calculate the interest for the next period.

Calculation of Compound Interest:

And so on….

The longer your investment can remain continuous, the more your wealth can grow.

Summary:

There is no such thing as Free Lunch. You need to give at least one of the below,

In Power of compounding, you need to give time. Hence, start early, be disciplined & have patience in investment.

I hope you get your answer like my client Mr. Kumar.

Happy wealth!

Important – Financial Services in Nashik, Financial Services in Thane, Financial Services in Jalgaon, Financial Services in Pune