Bonds and debentures, both fall under the debt category in investment. There are some differences between these two. We can say that all debentures can be considered bonds, however, all bonds are not debentures. Both investment products are used to generate income, from an investor’s point of view. Similarly, from a company’s or Government’s perspective, bonds and debentures are issued to raise capital from the general public.

The purpose of issue of Bonds & Debentures:

The main purpose behind the issuance of bonds & debentures is to generate extra money from the market. This money will be invested by private and public organizations in their businesses and projects for development, expansion, and growth purposes.

Let’s understand their differences in detail.

Bonds:

As per the definition, the bonds are offered by private companies, government agencies, and financial corporations to raise capital and invest money into the business from the public.

In simple words, a bond is a kind of loan given to private companies, government agencies, and financial corporations by the public. The public lends money to borrowers for a specified interest rate and borrowers repay back this loan on the date of maturity. To raise this fund, a document acts as an IOU (I owe you) between bond lenders (Public) and borrowers (Institutions). The borrower promises the lender, the return of capital upon maturity.

A bond is considered a good option for retail investors as it is a secure and stable source of investment. It also offers a little higher fixed rate of interest than a bank’s fixed deposit.

Investors can purchase bonds online using secure platforms namely India BondsIndia, GoldenPi, and others in India.

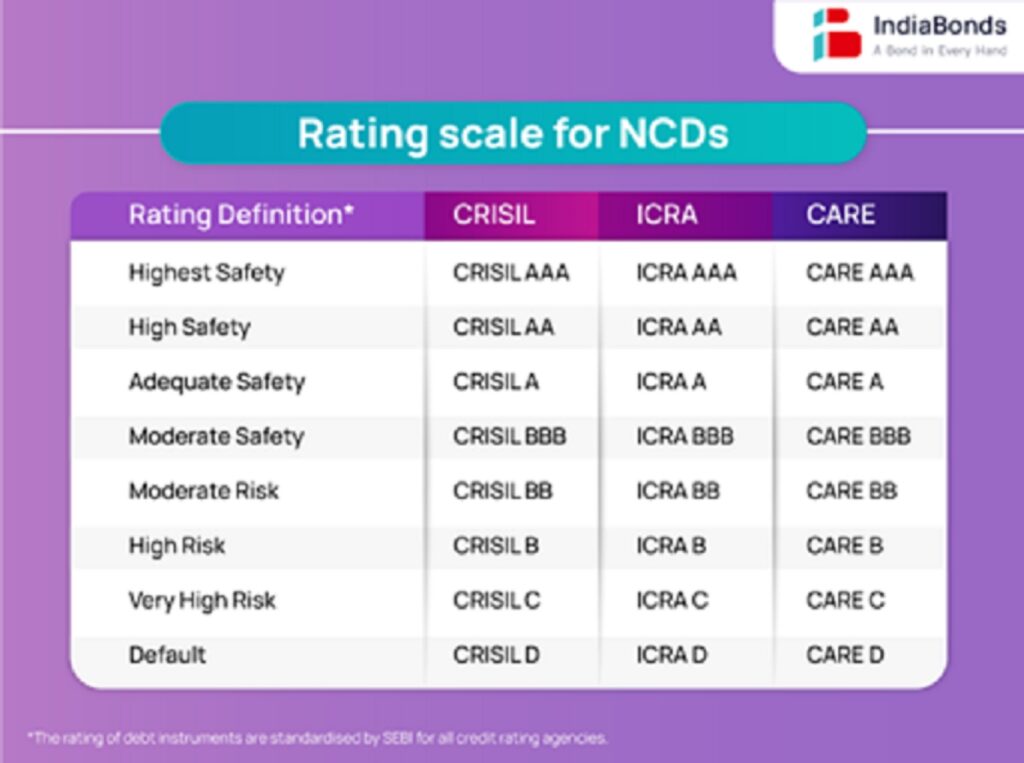

Rating of Bonds & Debentures:

The three most important major independent credit rating agencies in India CRISIL, ICRA & CARE rate the bonds in India.

Source: indiabonds.com

Source: indiabonds.com

Investors should check the bond ratings to identify a bond issuer’s creditworthiness. It indicates whether the issuer can fulfill the bond contract’s terms. In short, whether the bond issuer can pay back the principal and interest amount on due dates.

Till rating ‘A’ (Adequate safety), investment can be done. Higher the rating, the safer the investment.

Debentures:

Debentures are also called debt instruments like bonds, but the difference is that they are issued by private companies for a special purpose. The special purpose can be something such as the expansion of the company or starting a new project, etc.

Debentures do not have collateral (Security) and hence investors are advised to look at the credit worthiness of the company before investing. Governments generally issue it for more than 10 years term. Like bonds, debentures can also be purchased online.

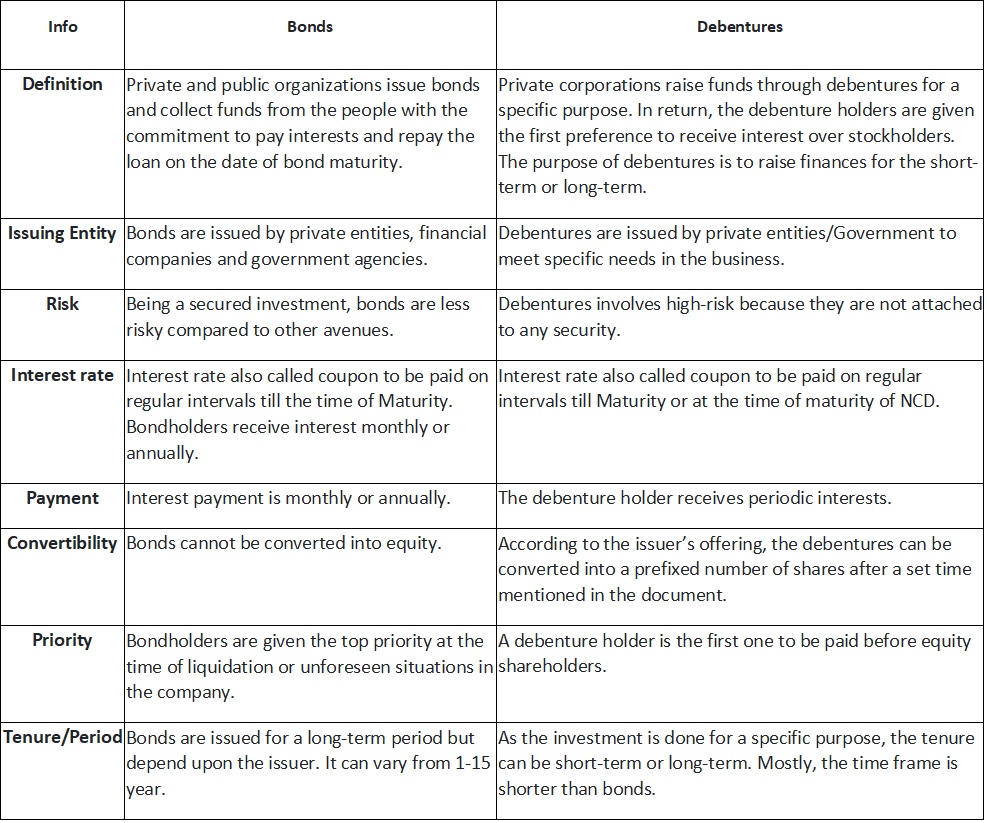

Differences between Bonds & Debentures:

Who Should Invest in Bonds & Debentures?

Conservative Investors who does not want to take risk, can invest in bonds, after checking the rating, as Bonds, carry less risk and they are backed by security.

Being a little more risky and unsecured investment than bonds, debentures can offer comparatively higher returns. Debentures can be good as a short-term investment. After going through both the pros and cons of the two, it’s up to investors to decide whether to invest in bonds or debentures based on your investment objectives and risk profile.