While purchasing something valuable, you make sure about its safety. It can be House, Car, Gold or any other stuff for that matter. You insured your valuables. You would prefer a house with 24/7 Security, Car with Airbags, Jewellery to be kept in a locker.

Whenever there is any chance of ‘Risk’, we take all safety measures to keep things “Safe” and “Secure”. Human Mind works like that at.

The same logic applies to Investment. You must have heard that famous line “Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing”.

As I said earlier, whenever there is a risk, we tend to avoid it. Hence, many people are reluctant to invest in Equity Mutual funds. However, you need to understand here that the investment risk does not come alone, it comes with a reward. We call it Return. Market Risk in investments is generally related to Equity Asset Class.

You can take risk only if you know what the risk exactly is. Risk in the equity asset class is nothing but the volatility of price of Share or Stock of a Company.

It is not possible to accept only returns and avoid risk. It is like Heads and Tails, two sides of a coin. Risk and Return are two sides of an investment. If you expect very high returns from your portfolio, you are indirectly ready to take higher risk for the same.

I will not say that this is right or this is wrong. Every Financial Product has its in-built risk and return capacity. Actually, ‘Financial Awareness’ is to understand when to choose risk, when to give importance to returns or when to avoid risk.

So, what you can do is instead of focusing on products available in the market, you first have to understand your needs, risk tolerance level and available resources. Then, match it with the products available.

Asset Classes :

| Asset Class | |||||

| Equity | Debt | Commodity (Gold/Silver) | Cash | ||

| Need money | Within 1 Year | No | Yes | No | Yes |

| 1-3 years | No | Yes | No | Yes | |

| 3-5 years | Yes | Yes | Yes | No | |

| 5-10 years | Yes | Yes | Yes | No | |

| 10 years & above | Yes | Yes | Yes | No |

Above table roughly indicates which asset class is suitable for which time period.

Percentage of Asset allocation (Equity/Debt/Commodity/Cash) can be different for every person according to various other factors such as age, income, Net worth, risk taking capacity etc.

Choosing the products means choosing the risk for your money. The Return part comes into the picture later.

Scenarios where you can take risk in investments –

1. When you don’t need your money back within 5 years

2. You have more than one income sources

3. There is more than one family member earning.

4. You have sufficient assets (Liquid/Immovable) to generate passive income in case of need.

Another very important point is,

“Do not take Risk with the Money required for Survival.”

Here, I am talking about the minimum monthly expenses which cannot be avoided. That can be Groceries, insurance premiums (For Term Plan) and Loan EMI, if any. These expenses can be considered as unavoidable for survival. It is your “Daal-Roti”.

Make sure you would get it from Guaranteed Income Source (Debt Investment). Better, if backed by Government Guarantee. Avoid market risk and default risk with this money.

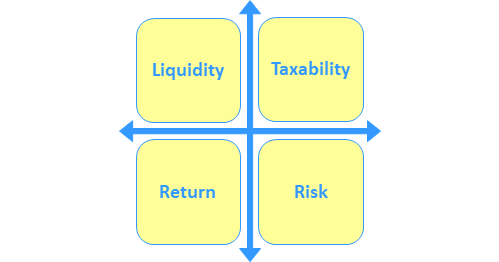

Just like Risk & Return, other 2 parameters are also important while investing.

Let’s understand other two parameters,

Liquidity:

- First parameter is Liquidity. It means how quick you can convert your assets in cash.

- For example, Mutual Funds units, Shares, Fixed Deposits etc. can be easily converted into cash, hence, they are liquid assets.

- On the contrary, House property, shops and land are illiquid assets as they take time to be sold.

- As a thumb rule, you should have 60% of your assets in liquid form. This will help you raise cash in the time of need.

- Your short term financial needs will be taken care of by your liquid assets.

Taxability:

- Second parameter to be considered while investing is Taxability. Based on your annual income, figure out your tax slab.

- Compute your tax liability and make a provision for the same.

- Choose the investment product after taking into account its tax treatment.

- In Debt Category “PPF” (Public provident Fund) is the best option for Tax Saving.

- It offers “EEE” status i.e. Exempt status at all levels. Investment qualifies for deduction under Income Tax, income earned from the said investment is tax free and maturity proceeds/withdrawal is also tax Free.

- In Equity Category Equity Linked Saving Scheme (ELSS) is a good option.

- It offers “EET” status. It means only taxable at the time of withdrawal after completion of lock-in period.

- Further, ELSS is having the shortest lock-in period and also being an equity product, taxation is also on the lower side.

- If you ignore the impact of tax on investments, your real returns in the long term (after maturity) may be much lower than expected.

Summary:

When it comes to survival and emergency, Returns don’t matter. Hence, don’t take risks with Daal-Roti. Trust me, if this is guaranteed, you would feel free to take Equity exposure for other financial needs. This strategy will give you Financial Stability, sense of comfort and peace of mind in life.

Also Read – Why should I Invest in Debt Funds?