Parents always want their child to be independent. Physically independent, mentally & emotionally independent and also ‘Financially Independent’. But, just earning money doesn’t mean financial independence. Because managing money is much more important than earning it.

If you want to make your child financially independent, then the journey begins for the early age of your child.

Your child should be taught the right lessons about savings and investments in school education, but unfortunately, this is not the truth. The School system does not provide this knowledge completely. Hence, this part should be taken care of by you.

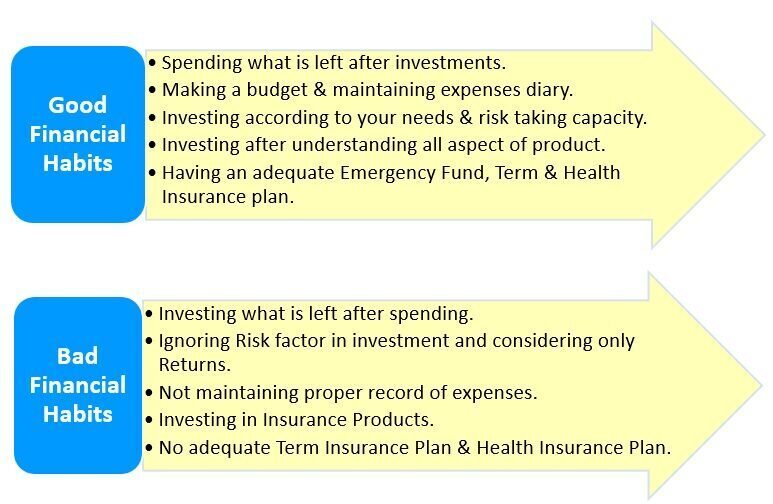

So, let us first understand the difference between a good financial habit and a bad financial habit.

After understanding what the good financial habits are, it’s time to understand how to inculcate it.

Below are the 6 simple ways to inculcate good financial habits in your child (for different age groups),

1. Gift a Piggy bank to your child

This is suitable for age groups up to 10. This is the very first step which you can do. This will help to generate a habit of saving in your child.

2. Teach your child to manage money through ‘Stories’

Stories are the best way of communicating messages to your child. It will not only grab the attention of your child but also help them to remember the moral of the story. You can tell them stories like Rice & Chessboard.

3. Give pocket money to your child

This can be suitable for age groups from 12-14 years. Observe them how they spend the money. Teach them to save money for special occasions, for example for birthday gifts. This will also create a sense of achievement and they will learn to save before spending.

4. Talk about household expenses, budgeting and investments in front of your child

You can do this if your child is 13-14 years old. This step will make your child familiar with these concepts which are used on a daily basis. Let them learn the importance of budgeting. You can also delegate some part of your work to them for example calculating monthly surplus, record keeping of expenses etc.

5. Let your child take part in your discussion regarding household finance management

You can do it if you child is old enough and if you have implemented what is mentioned in the 3rd point. Allowing your child to take part in your discussion will develop the ability of decision making and thought process of your child. Let them voice their opinion. Correct them in case of need.

6. Open a minor saving bank account in the name of your child (Below 18 years)

Many banks provide the facility to open a minor Saving Bank Account from the age of 14 years up to 18 years. This will help your child to be familiar with banking transactions.

Summary:

A person will do the same thing which he is habited to do. Our habits decide our destiny. Hence, inculcating good financial habits in the early age of your child is a very smart move in parenting.

You must have heard a famous quote, “Children are just like wet clay, you can shape them as you want. So, mould them into their best version!”

Only Financially Literate children can create a better Financial Future.

Follow us on Facebook

Also Read – Personal Finance Learnings from Bollywood Movies